Our sustainable investment philosophy

The University has appointed Mercer Investments (Australia) Limited (Mercer) as our Implemented Consultant. Mercer's expertise includes intergrating Environmental, Social and Governance issues (ESG) into portfolios, ensuring effective investment stewardship, selecting and monitoring investment managers, providing strategic advice, constructing portfolios, and making tactical asset allocation (or rebalancing) decisions. As a founding signatory to the United Nations Principles of Responsible Investment (PRI) since 2006, Mercer is a leader in responsible investment.

Where relevant and aligned, Mercer seeks to implement the following key techniques to achieve our sustainable investment objectives:

- Integrating ESG considerations into investment processes'.

- Seeking to make investments linked to sustainability-themes.

- Integrating climate change considerations into investment processes.

- Undertaking active ownership activities, which encompasses engagement and proxy voting.

- Seeking to avoid certain investments.

UWA will endeavour to monitor Mercer’s sustainable investment and ESG approach through appropriate due diligence and reporting. In addition, UWA holds regular meetings with Mercer to ensure that a sustainable investment approach is being applied and integrated across our investments.

This report provides an overview of key ESG considerations applied to the UWA portfolio managed by Mercer as of December 2023.

UWA believe a sustainable investment approach is likely to create and preserve long-term investment capital since:

- ESG factors can have a material impact on long-term risk and return outcomes;

- Climate change poses a systemic risk, given the potential financial impacts of the associated transition to a low-carbon economy and the physical impacts of different climate outcomes; and

- Stewardship (or active ownership) supports a stakeholder expectation to be good stewards of capital and assists the realisation of long-term shareholder value.

The University’s Investment Policy Statement (IPS) sets out UWA’s overall philosophy, commitment and methodology for addressing ESG factors within the University’s Investment Portfolio. Section 13 of the IPS outlines UWA’s ESG commitments, specifically to:

- Integrate ESG factors through the Implemented Consultant’s* portfolio oversight on systemic risks linked to ESG, assessing Investment Managers and assigning ESG ratings and actively engaging with Investment Managers to encourage improvement.

- Exercise our ownership rights, including company engagement and share voting in a manner consistent with active ownership and stewardship of the invested assets, via the Implemented Consultant.

- Assess climate change-related risks and opportunities in our investments and to manage them accordingly with the Implemented Consultant expected to report on carbon metrics and reduction strategies, active ownership, investment in sustainability themes, and disclosure consistent with the Taskforce on Climate-related Financial Disclosures (TCFD).

- Assess and address modern slavery risk as part of the investment process via the Implemented Consultant and Investment Managers, consistent with the Modern Slavery Act 2018 requirements.

- Exclude specified investments via the Implemented Consultant, and monitor and respond to significant issues such as human rights abuses, labour rights abuses, severe environmental pollution and corrupt business practices.

*UWA’s Implemented Consultant is Mercer. Mercer provides investment services including investment research, strategic investment advice and the implementation of approved investment strategies through a select range of investment products.

At a glance*

Active ownership

Mercer (UWA’s Implemented Consultant) voted at 99% of Australian and global meetings

Carbon footprint

The weighted average carbon intensity for UWA’s investment portfolio is 24.9% below benchmark.

Exclusions

UWA’s investment portfolio excludes tobacco and controversial weapons.

Our investment approach

We believe a sustainable investment approach is likely to create and preserve long-term investment capital since:

- ESG factors have a material impact on long-term risk and return outcomes and should all be integrated into the investment process;

- Climate change poses a systemic risk, and investors must consider the potential financial impacts of both the associated transition to a low-carbon economy and the physical impacts of different climate outcomes; and

- Stewardship (or active ownership) supports a social obligation to be good stewards of capital and assists the realisation of long-term shareholder value.

Dashboard view of 31 December 2023 report (using the four-pillar approach)

-

Pillar 1: Integration

Objective:

Take a broader view on risk / return by including environmental, social, and governance (ESG) factors in decisionsExample:

- Review manager ESG ratings and promote integration with managers

- Climate scenario analysis and transition risk analysis using multiple metrics

- Diversity and modern slavery analysis

2023 highlights:

- ESG ratings

The overall portfolio’s weighted average ESG rating is 1.80, which is 8% better than the universe - Carbon footprint

The weighted average carbon intensity (WACI) for listed equities is 24.9% below its benchmark. The overall portfolio has decarbonised by 12.0% (on a carbon footprint basis) from a 2020 baseline (128.0 v 145.3 in 2020). - Climate transition

Mercer has completed climate transition analysis which can be used as a tool by UWA to assist in establishing a decarbonisation pathway

-

Pillar 2: Active ownership

Objective:

Help realisation of long-term value through voting and engagement.Application:

- Work closely with appointed listed equity investment managers on voting and engagement.

- Engage with companies and policymakers either directly or via managers and/or collaboratively.

2023 highlights:

- Engagement

Mercer has an active engagement program with managers, collaborations with industry associations, and some portfolio companies directly. - Voting

Mercer’s appointed investment managers voted on Mercer’s behalf at 99% of Australian and global meetings. - Modern Slavery

No companies with high severity Modern Slavery flags were identified.

-

Pillar 3: Investment

Objective:

Explore investment opportunities linked to sustainability themes and solutions.Application:

Support UN Sustainable Development Goals (SDGs) and measure SDG alignment for Mercer sustainable labelled funds.2023 highlights:

- UN Sustainable Development Goals (SDGs) alignment

Support UN Sustainable Development Goals (SDGs) and measure SDG alignment for Mercer sustainable labelled funds.

- UN Sustainable Development Goals (SDGs) alignment

-

Pillar 4: Screening

Objective:

Screen portfolios for certain sectors, products or activities that meet Mercer Funds exclusions criteria.Application

Screening of certain products and activities.2023 highlights:

- Screening

No breaches of current exclusions criteria were identified.

- Screening

2023 highlights

-

Integration – ESG ratings progress

Mercer’s ESG ratings reflect to what extent the appointed managers integrate environmental, social and governance (ESG) factors into the investment process.

- At 31 Dec 2022, the weighted average ESG rating of UWA’s total portfolio was 1.80, slightly ‘outperforming’ the relevant, composite Universe ESG rating of 1.95 by 8% (0.15).

At 31 Dec 2023, the weighted avg. total portfolio ESG rating was 1.80, meaning no material change in the average rating this year.

2021 2022 2023 Year on Year Weighted Average ESG Rating 1.89 1.8 1.80 0.09 / 5% Summary

- The weighted average ESG rating of UWA’s portfolio continues to be better than the universe* (1.80 vs. 2.21)

Methodology

- Mercer’s ESG ratings reflect to what extent the managers integrate ESG factors into the investment process. A rating of 1 is for the strongest ESG practices and 4 is for the weakest ESG practices.

- The Universe is based on the aggregate ratings for all strategies in the relevant asset classes within Mercer’s Global Investment Manager Database (GIMD).

- The ratings are based on in-depth due diligence following Mercer’s Four Factor Framework (Idea Generation, Portfolio Construction, Implementation, and Business Management).

-

Active ownership – Engagement

The UWA Investment Portfolio represents the aggregation of debt and equity held within a range of underlying companies. Ownership provides UWA, through Mercer, with the scope to directly influence companies by exercising voting rights and/or actively engaging with senior management. Divestment of ownership, while an option in certain circumstances, removes the influence Mercer can have on behalf of UWA with underlying companies. Investors believe that by actively engaging with companies they can better influence and aim to change management to deliver improved and more sustainable outcomes. Engagement can be light touch, via letters, or more active, through conversations with management and Boards to set expectations on strategy and implementation. Mercer partners with its external investment managers to understand their direct engagement with companies, through an annual survey below, targeted follow up and topic-specific discussions.

Below and right are extracts from Mercer’s latest Manager Engagement Survey.

External manager engagement survey results 2023

Response rate in the Pacific

91% Have SI/RI/ESG Policy 99% Have formal engagement policy 96% Monitoring the UN Global Compact red flags, or similar 89% Reporting under Modern Slavery legislation 85% Asset class results awarded 4/5 starts by the PRI at latest review 74% Prepared climate change disclosure statement in line with TCFD 72% Consider nature/biodiversity in investment decisions 61% Have set climate transition targets 38% Listed strategies have more than 30% of the strategy's key decision makers identify as female 21% Examples of collaborative engagements Mercer has participates in Investor Groups on Climate Change Contributed to IGCC submissions on sustainable finance strategy and mandatory climate disclosures. Mercer participated in a two-day Canberra engagement with MPs and department reps. Mercer rep on Board. Climate Action 100+ Delivered updated benchmark and new sector criteria for highest emitting global companies. Responsible Investment Association Australasia Participating in First Nations Working Group and Human Rights Working Group - Mercer rep on Board. Proxy Voting Meeting Mercer's managers voted on Mercer's behalf 99% Voted against management's recommendation 8.1% Super votes exercised 0 -

Climate change

Both UWA and Mercer, recognise the scientific guidance on climate change and the importance of transitioning away from fossil fuel reliance at the pace required to keep the additional average temperature rise to ‘well below 2°C’, as per the 2015 Paris Agreement. That means transition action is required today to avoid delayed and disorderly transition later and the worst of the physical damage and loss impacts that come with even higher warming scenarios.

UWA has set a 2040 net zero emissions target across the University’s activities. UWA’s globally invested portfolio, managed by Mercer, is currently aiming for a net zero emissions 2050 target. The UWA Investment Committee will continue to work with Mercer to increasingly align the investment portfolio with UWA’s target where possible.

Mercer has been focused on climate change for investors since it’s first major paper in 2011 and its Investing in a Time of Climate Change research on climate scenario analysis for investors in 2015 and 2019. In late 2020 Mercer established an Analytics for Climate Transition tool and advice framework to help investors set net zero emissions targets for portfolios, with confidence in how investment objectives could still be met. The approach to transition can be explained in diagram below

Source: Mercer Investments (Australia) Limited

-

Climate metrics and measurement – Emissions intensity

Weighted Average Carbon Intensity (WACI) is the measure of the portfolio’s exposure to carbon-intensive companies, expressed in tons CO2e / $M revenue.

WACI vs Benchmark

Summary

- Portfolio WACI vs composite benchmark: -24.9% Equities only (see chart)

- The total WACI of UWA’s Equities investments is significantly lower than the equivalent composite equity benchmark of 157.8.

- The total portfolio breakdown is shown in the table.

Portfolio WACI

Portfolio WACI Benchmark WACI (BM WACI)

Portfolio vs Benchmark

Australian Equities

147.3 163.2 -9.75% Global Equities

91.1 120.9 -24.68% Emerging Markets Equities

117.8 327.6 -64.05% Property 51.4 70.7 -25.88% Infrastructure 400.8 1,005.1 -60.12% Fixed Income* 283.2 311.0 -8.92% Total Portfolio

149.0 - - Methodology

- WACI is a recommended metric of the Taskforce on Climate-related Financial Disclosures (TCFD).

- Going forward we will provide WACI as a secondary metric for reporting purposes.

- Total portfolio total in the table represents corporates and sovereigns WACI figures combined. This is weighted and combined to provide a total portfolio number in alignment with previous years analysis.

- However, going forward due to the methodology differences in the way WACI is calculated for corporates vs sovereigns, these will be split out and reported separately. In 2022, the Partnership for Carbon Accounting Financials (PCAF) issued industry standard guidance for sovereign emissions, which was implemented by our third-party data provider, MSCI. Going forward UWA will begin reporting sovereign emissions as well as corporate fixed income and providing two different intensity metrics.

- Reporting now includes a mix of actual data and proxied data, with the intention to further build out actual data coverage over time.

- *WACI data collection follows a different methodology for unlisted real assets and sovereigns.

-

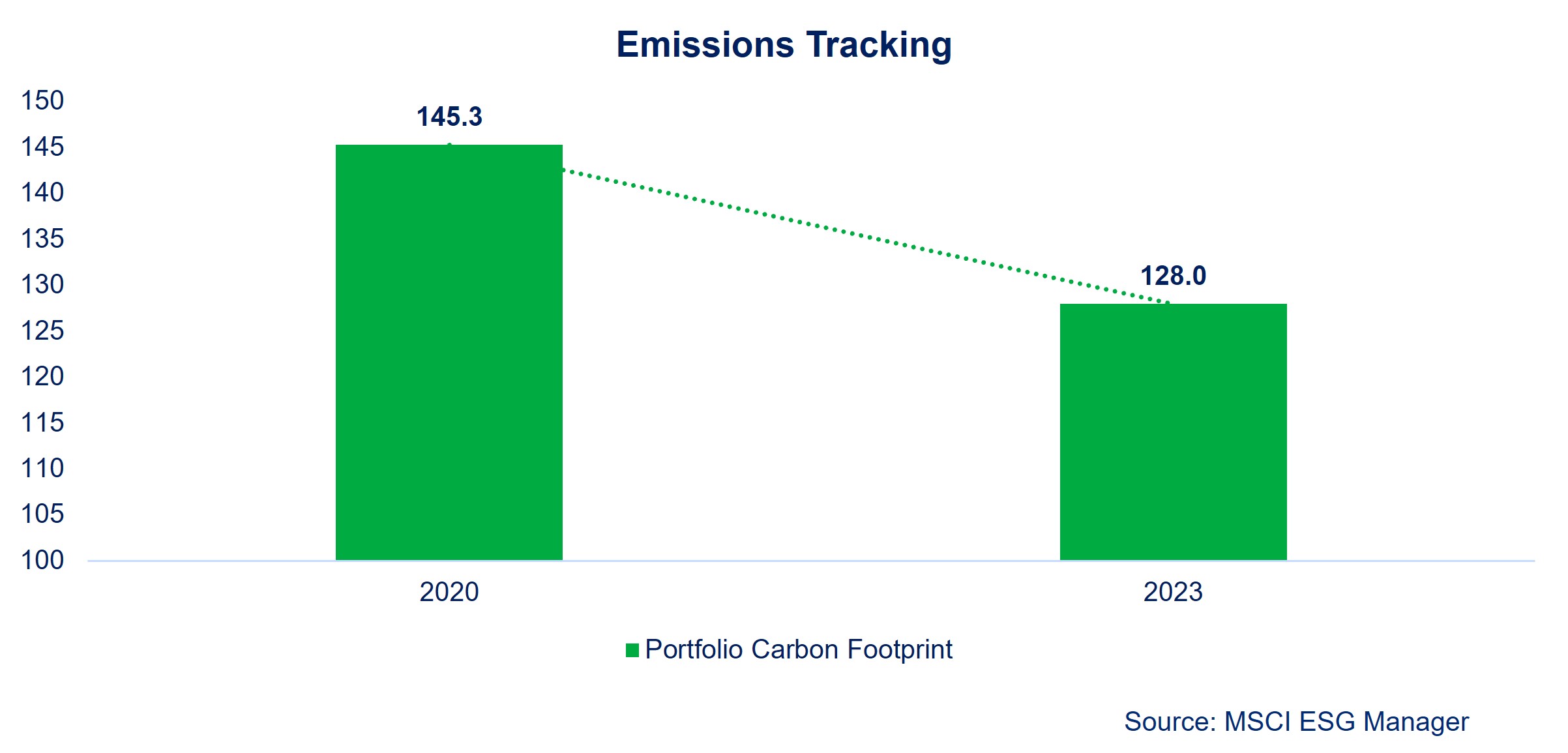

Emissions tracking - UWA portfolio

Mercer uses absolute emissions as metric to measure and report on overall portfolio emissions. Absolute emissions is the industry preferred metric due to its direct link to atmospheric emissions. WACI (previous slide) will continue to be reported as a secondary metric and used by internal portfolio management teams for investment decision making. Another common term for absolute emissions is portfolio carbon footprint.

Going forward, UWA will look to use absolute emissions as a key metric to measure and track its commitment to net zero for its investments managed by Mercer.

Emissions Tracking

Summary

- As at December 2023, Mercer Funds in which UWA are invested have decarbonised by 12.0% on an Absolute Emission basis basis against a 2020 baseline year.

Methodology

- Emissions data sourced from MSCI ESG Manager.

-

Climate metrics and measurement – Transition capacity

In addition to climate scenario modelling, Mercer’s proprietary Analytics for Climate Transition (“ACT”) tool is forward looking, going beyond just historical emissions, to assess holdings-level exposure on transition capacity and, importantly, stranded asset risk given the transitionary environment that is now well underway.

The below chart shows the categorisation of fund holdings by transition readiness and by weight in the portfolio.

Source: Mercer Investments (Australia) Limited

Summary

- The majority of UWA’s assessed portfolio is categorised positively for transition capacity.

- The University has limited exposure to ‘grey assets’ at 1.6% (of which 0.6% is in the dark grey category).

- Mercer continues to engage with its appointed managers on transition progress across its underlying companies and participate in collaborative engagement with the top emitting companies globally.

Methodology

- Mercer’s ACT tool consolidates 15 different underlying metrics including emissions, potential emissions from reserves, transition preparedness, UN Sustainable Development Goals (“SDG”) alignment and solutions revenue.

- The unassessed portfolio component includes cash and derivatives.

- The Implemented Consultant’s approach is outlined further in its Investment Approach to Climate Change*.

The Grey The In-between The Green carbon intensity,

low transition capacityvarying carbon intensity

and transition prospectslow carbon intensity,

high transition capacity -

Modern slavery

UWA is against slavery in all its forms and strives to respect human rights across the organisations’ activities. Mercer is committed to assessing and seeking to address modern slavery risks in its investment processes, and asking its appointed investment managers and investee companies do the same.

The diagram below outlines the components of the Implemented Consultant’s modern slavery program and the activities that have been undertaken.

Assessing and understanding modern slavery - Dedicated modern slavery risk assessment

- Training and education

- Research

Addressing modern slavery - Beliefs, policy and process

- Integration

- Active ownership

- Screening

Monitoring, reporting and disclosure - Annual monitoring

- Internal and external reporting

Source: Mercer Investments (Australia) Limited

Summary

The asset class risk assessment and holdings-level country and industry risk assessments identified potential hotspots in emerging market equities and bonds. Some of the highest risk country exposures identified in the emerging market shares portfolio included, India and China.

Modern Slavery Incident Indicator

There were no holdings with red flag incidents in any Mercer Funds

Methodology

Mercer has an investment specific modern slavery approach, which includes an ongoing program of engagement with managers based on red flags, holding risk assessment results and manager surveys.